how to earn 31.5% back on everything

the math behind my 12 credit cards

I love games. From Pokémon Go to Chess, I find deep joy in rabbit-holing into a game’s rules and nuances – compiling data to manufacture win conditions.

At 18, I stumbled across a new game – credit cards. What began as wanting to build bulletproof credit has turned into 12 cards, a score of 817, and a healthy amount of rewards.

Like most games, this one is more fun to play with others. I’ve been getting friends and family into this hobby of mine for the past three years, helping them capture outsized rewards for an activity they already do daily – spend money.

It’s about time I taught this game to a wider audience. I hope you have as much fun playing as I do.

Primer

This guide will cover the following:

The three levels of credit card optimization – from basic category spending (3-6% returns) to advanced churning (15-40% returns)

What churning is – repeatedly opening new cards for sign-up bonuses (SUBs) rather than optimizing everyday spending categories

Who churning is for – the time commitment and scalability associated with churning + profiles that benefit most (and least) from this activity

Anti-churning rules – how banks like Chase (5/24), Bank of America (2/3/4), Citi (1/48), and Amex (once in a lifetime) limit your card approval and bonus eligibility

Churning best-practices – planning your next 2-3 cards, finding elevated offers, using referrals, and timing applications

Advanced tactics – business cards without a “real” business, manufactured spending, product changes, and international considerations

Card management – when to keep, change, and close cards

What happens next – how to cash out your points for maximum value and track multiple cards systematically

My player profile

This is not financial advice – just how I am playing the game at the moment. That said, this section is for those curious as to what my personal lineup looks like → what makes me qualified to write this guide. If you’d rather get straight to the how-to, skip ahead to Levels.

Cards

I’m 21, and I have opened 12 credit cards*. They are:

Bank of America Customized Cash Rewards

Apple Card

Bilt Mastercard

Citi Custom Cash

Chase Freedom Flex

Amex Blue Business Plus

CitiBusiness AAdvantage Platinum Select World Elite (Closed)

Chase Ink Business Preferred

Chase Ink Business Cash

Chase Sapphire Preferred

Chase Ink Business Cash (#2)

Chase United Quest

Q&A

Your credit score must be shot?

My credit scores are 817 (Vantage) and 793 (FICO).

Why do you have business credit cards? Do you have a business?

Not in the traditional sense. Read more about this strategy in Business Cards.

Why do you have two of the same card (Chase Ink Business Cash)?

That card allows me to earn the bonus twice. Read more in Business Cards.

How much have you earned from this?

At the time of writing, I’ve earned upwards of a million points / miles.

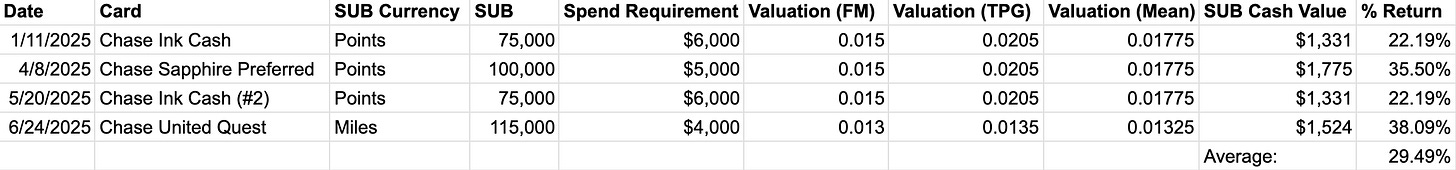

Returns

Let’s do the math. I opened four cards in 2025, all of which earned points or miles. To convert these currencies into USD values, I averaged a conservative valuation from Frequent Miler (FM)1 and an aggressive one from The Points Guy (TPG)2. This average valuation is generally consistent with what I have been able to attain on my personal award redemptions.

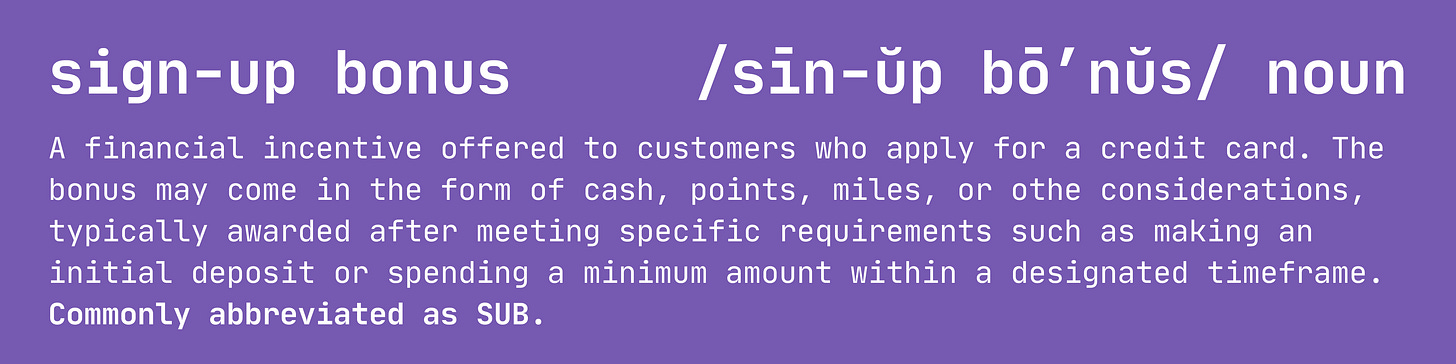

Using a card’s SUB’s cash value and spend requirement, we can find the % return for that SUB:

We calculated my personal SUB returns to be 29.49%, a number that does not include the additional rewards offered by each credit card (for example, all four of these cards offer 2–3% back on dining). For simplicity, given that most of my credit card spend is on restaurants (I currently live in New York), we’ll conservatively assume a 2% baseline rewards multiplier on my spend in addition to the SUB. That means for 2025, my approximate return on spend is 31.5%.

Note that these values exclude referral bonuses, which I used on 3/4 of these cards to create additional value for my referees. Read more in Referrals.

Levels

Just like any game, credit card optimization has levels to it. The three main levels are:

Categories

0-5 cards, optimizing spend categories and using multiple cards routinely.

Typical return on spend of 3–6%

Churning (Basic)

5+ cards, optimizing sign-up bonuses and usually only using one card at a time.

Typical return on spend of 15–40%

Churning (Advanced)

Using advanced strategies like manufacturing spend, redistributing credit lines, opening business credit cards, etc.

Typical return on spend of 20–60%

For the sake of this piece, I’m writing to those who are playing Categories and are looking to begin Churning. These players are accustomed to optimizing to maximize % rewards on everyday purchases, memorizing each cards’ benefits to earn incremental gains at checkout. These players are ready for what’s next.

Churning

Churning is the practice of repeatedly opening up new credit cards for the purpose of earning their sign-up bonus (SUB). This strategy optimizes for the percent return yielded by the SUB rather than the card’s categories.

For example – a category player rotates between multiple cards day-to-day, using one card at restaurants, another for gas, and so on. Given the baseline return for non-category spend is typically 1–2% and returns for category spend typically max out at 5–6%, the incremental delta earned from rotating cards is maximally 5%.

On the other hand – a churner carries just one card at a time, uses it until meeting the spend requirement for the SUB, and then opens another one. Returns here are primarily based on the SUB and can range from 10–40%, as demonstrated with my personal returns above. The most common cases in which churners would carry multiple cards simultaneously:

They are working towards multiple SUBs at once

A specific card gives them non-cashback benefits (free checked bags, priority boarding, rideshare credits, etc)

Who should play

The goal of this game is to save time and make money.

Time

There are three major time expenditures in churning.

First – learning anti-churning rules, which I briefly cover in a following section. Understanding the rules well enough to get started took about a week.

Second – deciding what cards to open. Once you have a strong understanding of anti-churning rules, this mainly comes down to tracking your statuses for relevant anti-churning rules and staying informed on elevated SUBs. This takes me ~2 hours per month. Some friends and I intend to compress this to 15 minutes per month, as alluded to in Tracking & Management.

Third – putting spend on new card. Aside from just carrying a new card in your physical wallet and setting a new primary card in your digital wallet, the primary time suck here is adding your new card to utility providers, checkout portals, and anywhere else that retains your payment info. This step is up to personal preference – I don’t bother swapping cards for subscription services, but I will pop in new cards at Costco and Grubhub. This takes me ~1 hour per month.

Note: These are the time expenditures associated with earning credit card rewards. There are additional expenditures associated with spending these rewards, particularly in a way that achieves maximum value (hence the valuations in Returns).

Money

Because most SUBs have spend requirements of $500 – $10,000 in 2-6 months, ideal churning candidates spend at least $200 per month. There is virtually no upper limit for two reasons:

Aggressive churners can earn SUBs at nearly uncapped frequency with enough research and proper timing.

There are some outliers with significantly higher spend requirements – the new Business Chase Sapphire Reserve, for example, requires $30,000.

That said, higher-velocity churning requires greater time and headspace inputs to avoid anti-churning rules, so churning may not be worth the effort for those who spend many tens of thousands per month.

Finally, I think it is worthwhile to calculate ROI from a time basis using both axes of time and money. For example, we valued one of my SUBs earlier at ~$1800. It took ~1 hour to learn about the elevated offer and submit my application, all while staying cognizant of anti-churning rules. Strictly looking at ROI in this way, I would consider this a good use of my time. That said, churning may also not be worth the effort for those who value their time upwards of $2000 per hour.

Anti-churning rules

Banks did not intend for credit cards to be used this way. SUBs are intended to incentivize new users to open new lines of credit, as the majority of revenue for credit card issuers comes from interest3. As such, banks guard against this type of activity with proprietary anti-churning rules.

You can find a comprehensive list of the major anti-churning rules on Reddit4. Here are abridged versions of some of the most well-known ones:

5/24 (Chase)

Chase will deny you if you have opened 5 or more credit cards across any issuer in the last 24 months that show on your credit report.

Note: Most business cards5 do not count against your 5/24 status.

1/30 (Chase)

If you've submitted any personal or business Chase credit card application in last 30 days, then any newer business card application might get denied due to 1/30.

Note: This is not a hard and fast rule like 5/24.

2/3/4 Rule (BofA)

This rule puts a hard cap on how many BoA cards you can acquire in a time frame:

no more than 2 BoA cards in 2 months

no more than 3 BoA cards in 12 months

no more than 4 BoA cards in 24 months

Note: Unlike 5/24, this rule limits only BoA cards and not those from other issuers.

1/48 (Citi)

Citi cards now have terms that state a bonus is "not available if you have received a new account bonus for this card in the past 48 months".

Note: One churning strategy is to prioritize opening cards with cooldowns like these so that the 48-month timer can begin immediately.

Once in a Lifetime (Amex)

You can only get signup bonus on an Amex card “once in a lifetime.” Once you hold a card (even if you didn't get signup bonus or got the card through product changing), you forfeit signup bonus for a "lifetime."

Note: Data points6 suggest that this “lifetime” lasts for ~7 years, though there are ways to earn a bonus sooner. For example – targeted offers with no lifetime language (NLL).

Do your own research!

Before churning, I recommend priming yourself on these rules to understand how applying for a credit card today can limit your application options tomorrow. In my experience, most seasoned churners can recite the major rules and their nuances.

Optimization

At this point, we understand churning as a concept and the rules that regulate it. Now, let’s talk about how to play the game.

Planning & Strategy

How do I know which card to open?

This flowchart7 will point you to various cards given 1) your unique situation and 2) most anti-churning rules.

Once you have a good enough grasp on the major rules, you can begin to plan your churning strategy up to 2–3 cards in the future. For example:

At the time of writing, I’m working on the spend requirement on my second Chase Ink Cash. I live in New York (pricey!) so I’ll earn the SUB by end of month.

I’ll be spending nearly all of August in Asia, during which I’ll use my Chase United Quest because it doesn’t have foreign transaction fees.

Upon my return, I’ll likely open up an American Airlines card from Citi because I’m running low on AA miles.

Any tips to optimize for high % returns?

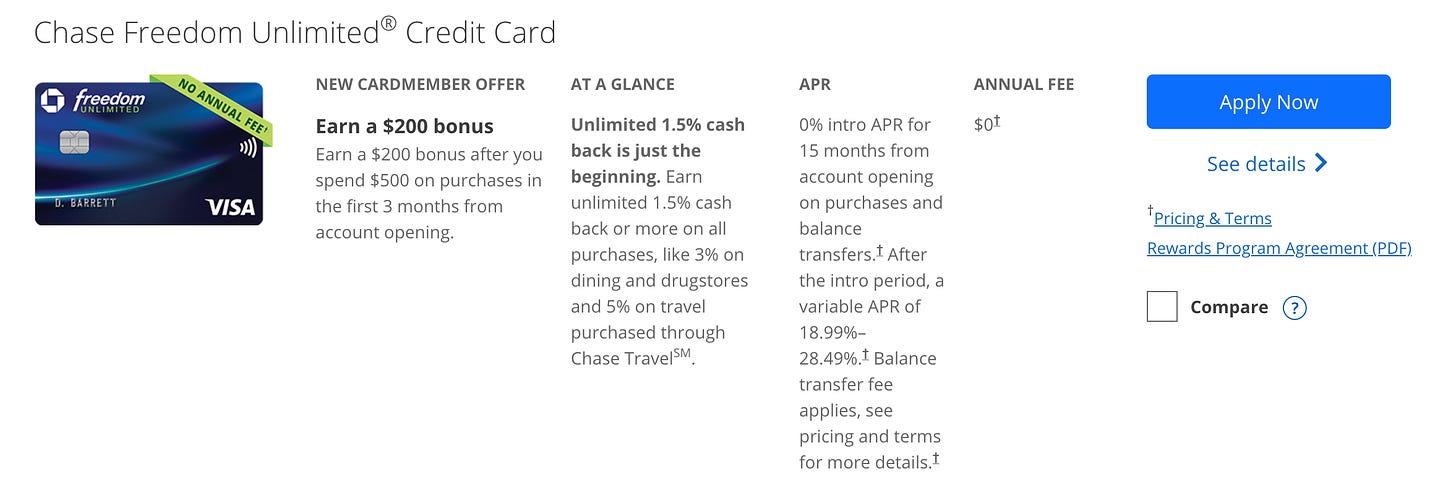

A common misconception is that higher % returns are correlated with higher spend requirements. While it is true that higher spend requirements typically reward higher bonuses, some of the highest % returns actually come from entry-level cards. The Chase Freedom Unlimited, for example, offers $200 after spending $500.

The SUB itself yields 40%.

Add the 1.5% cashback this card offers naturally – 41.5%.

This “cashback” bonus is actually distributed as Chase UR points (1.775x multiplier as previously averaged in Returns) – 73.7%.

Elevated offers

Most cards have limits on how often you can earn their bonus. How do I maximize my returns?

Occasionally, banks run promotions that raise a card’s SUB above what is typically advertised. These elevated offers run for a limited-time and can be found online, in targeted emails, in snail mail pamphlets, in referrals, over the phone, in-branch, etc. Churners have recorded datapoints of finding elevated bonuses via making dummy bookings on hotels8 and copying application links into incognito mode9. To find them, I typically check Doctor of Credit (DoC)’s list of best credit card offers10. To learn how elevated an offer is, DoC and TPG11 both share offer history of specific cards.

Because of these, as well as cooldown-type anti-churning rules like 1/48 or One in a Lifetime, my priority when deciding my next card is to target elevated offers.

Referrals

I’ve begun churning, but I want to get even more rewards out of each application. How?

Get a friend or family member (or me) to send you referral links whenever you apply for new cards. The bonuses from these can add up, particularly if you churn seriously and are opening 5+ cards per year. Typically, you can only be referred by cardholders of the desired card (only Chase Sapphire cardholders can generate referral links for Chase Sapphire cards).

Also, as aforementioned in Elevated Offers, referral links often boast exclusive, non-public offers.

Business cards

I have a few personal cards, such as the BofA CCR or Chase CSP. How do I avoid maxing out 5/24 or 2/3/4 too quickly?

Open a business card. Most business cards12 are not reported to your credit bureau and will therefore not count against the above rules.

But I don’t run a business?

You’d be surprised. It doesn’t matter what you do – selling items on Facebook Marketplace, freelancing occasionally, and even thinking about starting a business are all grounds to open a business card13. Me? I run a “startup consulting” business.

Does my “business” need to make money?

On business card applications, you will be asked for your business income14, though I have never been asked to verify it. That said, I do have legitimate income from working with startups and I’m able to share it if ever asked by a bank’s verification team.

Do I need an EIN?

No. If you indicate that your business is a sole proprietorship15, you can substitute an EIN for your SSN.

Do I need a business checking or savings account?

No. You can pay off business cards with your personal bank accounts.

Any other benefits?

Yes. Business credit cards often have significantly higher sign-up bonuses16 and referral bonuses, so I find I get more value out of the same card. Of my last seven cards, five have been business.

Of those five, two are the same – I have double Chase Ink Cash cards. This is because Chase Ink Business cards do not have any SUB-cooldown-type anti-churning rules (unlike their personal counterparts – the Sapphires and Freedoms), so I was able to open two in the span of five months. The only rule that would apply here is Chase’s 1/30 (aforementioned in Anti-Churning Rules), which limits my application timeline but not my ability to earn bonuses.

Finally, for every N registered business entities that you own, you can open N+1 multiples of the same business cards, using each entity’s EIN and your own SSN. For example, if you used your SSN and two EINs to open two of each of the four Chase Inks, that would allow (1 + 2) * 2 * 4 = 24 Ink cards.

Manufactured spend (MS)

I can’t hit a SUB’s required spend in time with my typical spending habits. Is there anything I can do?

Manufactured spending is the practice of artificially inflating your credit card spend by liquidating your line of credit into cash or cash-adjacent assets. You can find a primer on MS on Reddit17.

My favorite method of MS is buying gift cards. I typically use GCX to purchase gift cards for merchants like Uber, Chipotle, and Southwest – up to 18% off.

Foreign transaction fees (FTF)

If I do this right, I’ll be traveling all the time. How does churning work overseas?

One of the credit card benefits I derive the most value from is waived Foreign Transaction Fees (FTF)18. This is typically found on travel cards, airline cards, and hotel cards. To fully maximize rewards, I typically open a new no-FTF card a few weeks before overseas trips.

Other

There are a plethora of additional hacks. Credit limit redistribution to limit perceived amounts of new credit, applying to multiple cards within seconds of each other to evade anti-churning rules, and using special flight attendant codes to get exclusive deals for airline credit cards.

Throughout this guide, I’ve also completely omitted hotel cards and retail cards. These have SUBs as well, though they are too constraining for me to take interest in. I’m partial to Airbnb anyway.

To learn more about niche strategies and community datapoints, I derive the most value from Doctor of Credit19, r/churning20, and Frequent Miler21.

Additionally, you can churn bank accounts22 in a similar manner.

Squeeze, downgrade, cancel

I’ve earned a card’s bonus and have no additional use for it. What do I do with it?

If the card isn’t a financial liability, just put it in a sock drawer and forget about it (this is literally referred to as “sock-drawering”23 in the churning community). In most situations, it is generally advantageous to keep cards open as long as possible. The exceptions are:

The card has an annual fee that isn’t worth paying.

You have multiple duplicate cards (e.g. I have two Chase Ink Cash’s open) and want to avoid shutdowns24.

Your credit score is strong enough and average age of credit is high enough that closing a card wouldn’t be a significant detriment.

Clawbacks

As a golden rule, I always recommend keeping all cards open for at least a year.

Maximizing the lifetime of a card is beneficial to extend your average age of credit and has negligible monetary downside (you only pay annual fees (AF) once a year).

Closing or product changing a card before its anniversary could result in a perceived breach of the card’s ToC and the bank “clawing back” the bonus25.

“The dictionary definition of a clawback is "to get back (something, such as money) by strenuous or forceful means."

In the case of rewards credit cards, this takes the form of a bank reversing points, miles or even statement credits you previously received because they've decided you've done something against their terms and conditions or otherwise misused their program. Their terms give them permission to do this.”

– The Points Guy26

For this reason, the optimal time to make major changes to a card is after its anniversary. For cards with annual fees, this would be immediately after the annual fee posts. Rest assured, downgrading or canceling the card within N days of the card anniversary will result in this fee being waived or refunded, where N ranges from 30 – 90 depending on issuer and card.

Squeeze – Retention offers

“Once a credit card issuer has spent hundreds of dollars (with a welcome bonus in cash back, points or miles) to entice you to open a card, it needs to find a way to recoup that investment. If you close your card after only a year or two — especially if you aren't using it regularly — the issuer will likely lose money on you.

In an effort to recoup that investment, some (but not all) issuers will extend targeted retention offers to encourage customers to keep a card open longer. These offers can take the form of bonus points, statement credits, reductions or outright waivers of an annual fee — anything that helps persuade you to keep the card open (and, in the issuer's eyes, keep you spending on the card).”

– The Points Guy27

Retention offers are like a mini-SUB. In many cases, you are yet again given an offer with a spend requirement and spend timeline – it is then up to you to calculate the return on spend, compare it to alternative new SUBs, and determine if it is worth it to keep the card.

How do I get a retention offer?

Full guide here.

Downgrade – Product change

If you decide not to keep the card, you can call the card’s issuer and request a product change. For example, to avoid paying the Chase Sapphire Preferred’s annual fee, you can request that the card be downgraded to one without an annual fee, such as one of the Chase Freedom cards. This allows you to retain the card’s credit and payment history on your credit report (thus contributing to your average age of credit) while relieving you of the annual fee.

Do this with caution, as there are some instances28 where product changing may not be optimal.

Cancellation

So, when should I cancel a card?

If none of the above options are favorable for you, I would recommend cancelling the card.

Will cancelling a card hurt my credit score?

In short, not if you’re churning. This Reddit user29 explains it well.

What’s next

If you churn properly, you should be faced with two new challenges:

Cashing out

I have too many points / miles and need to learn how to use them for maximum value.

All of the aforementioned currency valuations hinge on liquidating these currencies for flights, hotel stays, and other redemption options for maximum value. Though less complicated than churning, a guide on efficiently redeeming points would warrant an entirely new blog. In the meantime, my favorite resources are Roame30 and PointsYeah31.

Tracking & Management

I have too many cards and need a system to manage them.

In the 12+ years since r/churning has existed, no one has built this yet. As much as this game has evolved over the years, cards themselves have been tracked on spreadsheets the entire time. Primitive, I know.

In contrast, imagine a card management system optimized for churning that…

kept track of your cards + their annual fees,

visualized your returns over time and calculated your average return on spend,

automatically computed your statuses for anti-churning rules,

detected elevated / all-time high offers and notified you of them,

and used all of the above data to determine what cards you’re eligible for + recommend what card you should open next.

I think that would be pretty cool. If you do too – https://wt.ls/suboptimized

Concluding remarks

In summary:

Churning is the practice of repeatedly opening up new credit cards for the purpose of earning their sign-up bonus (SUB).

Returns from category optimization pale in comparison to returns from churning.

Churning is governed by anti-churning rules, each with their own nuances and loopholes.

Plan ahead, watch out for elevated offers, and use creative tactics to maximize gains.

After earning a sign-up bonus, understand whether to keep, downgrade, or close the card.

If you’re just getting into the game, start with the basics – earn that first SUB, familiarize yourself with the rules, and level up from there. If you have any questions, feel free to comment below.

Happy churning :)

P.S. if you enjoyed this, I recommend “calibrating the objective function” or “centaurs, triple threats, and jacks of all trades” next.

https://frequentmiler.com/reasonable-redemption-values-rrvs/

https://thepointsguy.com/loyalty-programs/monthly-valuations/

https://www.nerdwallet.com/article/credit-cards/credit-card-companies-money

https://www.reddit.com/r/churning/wiki/anti-churning_rules/

https://travel-on-points.com/knowing-which-business-cards-affect-5-24/

https://www.reddit.com/r/amex/comments/1d8bqp2/lifetime_duration_data_point/

https://www.reddit.com/r/churning/comments/1l7p4kl/credit_card_recommendation_flowchart_june_2025/

https://www.reddit.com/r/churning/comments/8otfoe/psa_dummy_booking_for_amex_hilton_business_125k/

https://www.reddit.com/r/CreditCards/comments/sl9kgn/check_incognito_even_for_referrals/

https://www.doctorofcredit.com/best-current-credit-card-sign-bonuses/

https://thepointsguy.com/credit-cards/chase-best-welcome-offers/

https://www.doctorofcredit.com/which-business-credit-cards-report/

https://www.nerdwallet.com/article/credit-cards/can-get-business-credit-card-without-business

https://www.reddit.com/r/amex/comments/1hicmro/how_to_go_about_business_card/

https://www.chase.com/personal/credit-cards/education/basics/business-credit-cards-for-sole-proprietorships

https://www.reddit.com/r/amex/comments/1cnf232/why_are_business_card_sign_up_bonuses_much/

https://www.reddit.com/r/churning/wiki/manufactured_spending/

https://www.chase.com/personal/credit-cards/education/basics/foreign-transaction-fees

https://www.doctorofcredit.com/

https://www.reddit.com/r/churning/

https://frequentmiler.com/

https://www.doctorofcredit.com/a-beginners-guide-to-bank-account-bonuses/

https://www.reddit.com/r/CreditCards/comments/1gafgo1/how_do_you_manage_your_sock_drawer_cards/

https://thepointsguy.com/credit-cards/dont-let-chases-shutdown-pattern-bite-you/

https://www.reddit.com/r/churning/comments/5fnuao/new_dp_citi_clawed_back_prestige_sign_up_bonus/

https://thepointsguy.com/credit-cards/what-are-clawbacks-and-why-do-they-occur/

https://thepointsguy.com/credit-cards/ultimate-guide-credit-card-retention-offers/

https://www.nerdwallet.com/article/credit-cards/times-you-should-think-twice-before-asking-for-a-credit-card-product-change

https://www.reddit.com/r/CreditCards/comments/196l3y6/psa_cancelling_credit_cards/

https://roame.travel/

https://www.pointsyeah.com/

All sources up to date as of 7/7/2025.

International edition?

Hmm, interesting hacking of the system. I still need to get a credit card lol